Exchanging Is The New Business Paradigm

Thursday, April 9, 2015 at 3:15PM

Thursday, April 9, 2015 at 3:15PM One of the 3 Business Functions of any organization consists in capturing value through transactions. It is the Capture Function.

We’ve been used to consider two separate processes: Sales and Purchasing. On the one side, we think about the sales process as a way to capture money from customers in exchange of products (goods & services). On the other side, we think about the purchasing process as a way to acquire with cash the necessary supplies for the various operations of the company. Period.

But times have changed, and reality is now a bit different. The sales and purchasing processes are just 2 different “modes” for capturing value: they are part of a single Capture Function. There is, moreover, a third capturing mode: Exchanging. And it is getting big, especially with new technologies like Cloud, Web 2.0 and mobile applications.

To sum up, here are the 3 modes for the Capture Function:

- Buying mode: capturing cash in exchange of goods or services,

- Selling mode: capturing supplies in exchange of cash,

- Exchanging mode: acquiring goods or services in exchange to other goods or services.

Why is it important?

1- Capturing value works on both sides (with customers and suppliers)

We usually don’t recognize enough the fact that purchasing is potentially as much about capturing value as the sales process is. It just happens that most businesses focus on creating value through their capacity to generate good enough products and to sell them at a good enough price. But some companies can focus on other ways to do business, and capture most of the value through their buying process:

- Gold4Cash makes its money by buying gold for a very low price.

- Walmart is famous for bringing its suppliers prices down as well.

Exchanging is actually the way to play on both sides at the same time. Customers become "beneficiaries" and suppliers become "contributors"... and with exchanges, the same actor plays both roles

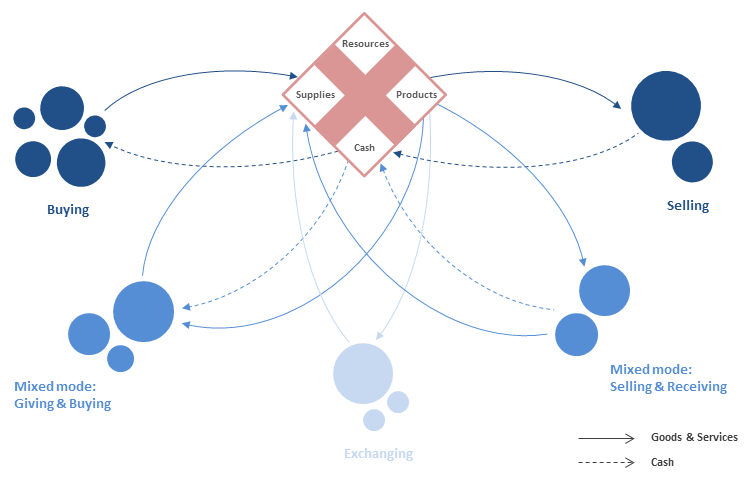

2- There is a single Capture Function, and different mixable modes

We can usually see businesses as systems that strive to increase their internal value. For this, they just:

- run processes (to generate products and build resources),

- make transactions (interact with the external world).

There are thus two ways to increase the internal value: having effective internal processes and achieving a positive balance with regard to transactions. With this logic, the Capture Function is just the ruler of the “transaction equation”. It should be seen as an integrated function that has:

- products and cash to provide on the one hand,

- cash and supplies to receive on the other hand.

Good business models show innovative ways to play with the components of this equation (see this Amazon example from a previous post). They often do that by mixing the Selling and Buying modes with the Exchanging mode::

3- Exchanging is the new way to go

Exchanging is just making a transaction without involving cash. Although it may seem rare (and often forbidden for physical products), it is actually everywhere (either in a pure form, or mixed with another Capturing mode). Most new business models (and some old ones) include some exchanges in one way or another:

- Facebook provides a service to its users, who upload personal data in the same process.

- TV channels provide programs and viewers give their attention.

- Waze provides a navigation service and users report information such as position, speed and events.

- Most web sites provide information, entertainment or services, and users provide (sometimes without knowing) their IP address, location, cookies etc.

And in a way, advertising in general is pretty much about exchanging: the company provides information or entertainment, and receives (hopefully) some awareness or propensity to buy in return.

Takeaways

Ask yourself how you can achieve a better balance of your transaction equation. For this:

- evaluate the value you can provide, and what supplies (or valuable inputs) you actually need.

- consider who your transaction counterparts are (and consider potential "benefiaries" and "contributors").

Then ask yourself if you could make the following moves:

- Moving from “Buying” to “Exchanging”: are there valuable inputs I can get without paying? What value can I provide in exchange?

- Moving from “Buying” to “Giving & Buying”: Is there a way to pay less for my supplies? Is there any value I can provide that will allow me to get a lower price?

- Moving from “Selling” to “Selling & Receive”: Is there a way to be more competitive with lower prices, and get additional valuable inputs in exchange?

- Moving from “Selling” to “Exchanging”: Should I stop charging for some products and get valuable inputs in exchange?

Supplies, in the broad sense of “valuable inputs”, are more diverse than we think, and they can allow such moves. Think about customer awareness, customer preference, customer commitment, customer loyalty, customer profile, customer data, knowledge, information etc.

For more insights and more examples: http://www.bm2business.com/capture-function/

Reader Comments